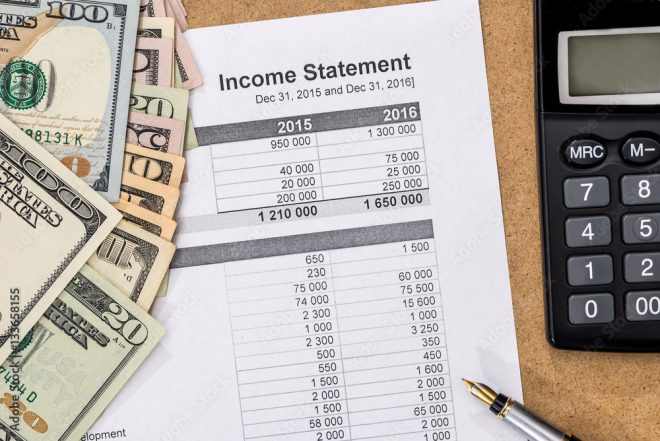

Understanding the Income Statement

The income statement is one of the basic financial statements that disclose the financial performance of a company. Profit and loss statement (P&L), statement of income, and statement of earnings are other names for the income statement. It focuses on the revenues, expenses, and net income or loss of a company over a reporting period. Reporting periods are normally monthly, quarterly, or an annual basis. Overall, the information on the income statement helps both internal and external users make important decisions regarding the business.

Revenue

Revenue is the income a business receives from the sale of goods or services in a period. Another term for revenue is sales. Many refer to revenue as the “top line” because it is the first section of the income statement. Most businesses have many streams of revenue that create the total revenue line. This section reports the gross revenue.

Expenses

Expenses are costs that a company incurs in effort to generate revenues. Examples of these costs are salaries for employees, rent, utilities, and materials needed to perform a service. The income statement reports these costs in multiple sections.

Cost of Goods Sold/Cost of Sales: This is the second section and it lists the company’s direct costs. Direct costs are expenses that a company can directly connect to the production of a specific good or service. This can include direct labor, raw materials, and equipment. The difference between revenue and cost of sales is gross profit.

Operating Costs: The operating costs section reports the indirect costs of a company. Indirect costs are expenses that apply to more than one company activity. A company cannot assign indirect expenses to a specific good or service. These costs include expenses to run a company. Rent, utilities, repairs and maintenance, and professional expenses are examples of indirect costs. Subtracting the operating costs from the company’s gross profit will provide the operating income.

Non-operating Income (Expense) and Taxes

Equally important are Non-operating items. These are activities that do not occur during the regular course of a company’s operations. They can be items that are one-time or unusual. This section can include both income and expenses. Interest expense and a gain or loss on the disposal of assets are examples of non-operating items. The difference between the operating income and the total of non-operating income (expense) is Income (Expense) Before Taxes. Next, the income statement reports the local, state, and federal taxes.

Net Income

Finally, Net income, or the “bottom line”, is the last line on this document. It is a company’s total income after deducting all business expenses. Net income is one of the most important lines on the income statement. This line reports how profitable a company is. If revenue exceeds expenses, then the company is earning profits. Conversely, if expenses exceed revenue, then there is a loss.

As shown above, the income statement is a great financial tool for a business and its external users. The statement must report accurate information to be beneficial though. A CPA can assist a business to ensure the accuracy of their income statement.

Contributed by Elizabeth Partlow