The Importance of the Income Statement

There are four basic financial statements: Balance Sheet, Cash Flow Statement, Income Statement and Statement of Retained Earnings. External users such as investors, creditors, etc. use these statements to gain insight into the financial health of a company. Internal users such as executives, shareholders, etc. use these statements to make informed decisions. This blog will specifically discuss the purpose of the income statement The income statement provides the amount of revenues and expenses of a company within a specific period of time.

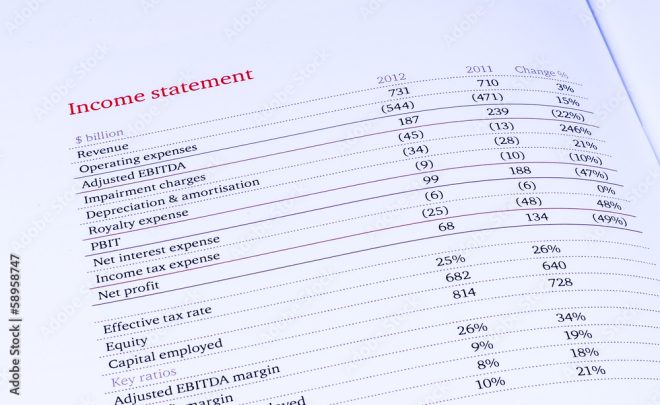

Elements of an Income Statement

Revenues

This part of the income statement shows the revenues generated and earned via products, goods, and/or services sold. In some types of income statements, there could be a line item for each type of revenue with the total sum for the specific period of the income statement. For example, a business with multiple revenue sources may have source subsections; such as service revenue versus product sales. Then the sum of the revenues subsections is the Total Revenue amount. Immediately following the Total Revenue/Total Income amount, is the Cost of Goods Sold/Cost of Sales section. This is where the identification and subtotaling of specific costs related to generating the revenues listed in the above section result. The Gross Profit is the next amount. This is the amount of money earned after subtracting direct costs from the total revenues. To calculate the Gross Profit, subtract the Cost of Goods Sold/Cost of Sales amount from the Total Revenue/Total Income amount.

Operating Expenses

The second part lists the operating expenses or business expenditures other than the Cost of Goods Sold/Cost of Sales. Here, companies will list the amounts of the business expenses such as fringe, overhead, general and administrative costs. They can also specify other business operation necessities such as, payroll, rent, insurance, interest, etc. The sum of these individual expenses is the Total Operating Expense. When subtracted from the Gross Profit value calculated in the first part of the income statement, it becomes Net Ordinary Income or Income from Operations.

Other Income and Non-Operating Expenses

The final section of the Income Statement includes the income and expenses that are not ordinary income/revenues or operating expenses. This is then subtotaled to get the Total Other Income/Expense or Non-Operating Income/Expense amount. The subtotal from Other Income/Expense is added (if incomes listed are greater than the expenses listed) or subtracted (if expenses listed are greater than the expenses listed) from the Net Ordinary Income or Income from Operations amount to get the Net Income. If there are taxes then this amount would actually be called the Income Before Taxes. Once the Income Tax amounts are listed, this subtotal of Income Tax or Income Tax Benefit would be deducted from or added to, respectively, the subtotal Income Before Taxes to get the Net Income or Net Loss.

Significance

Management can use the income statement to evaluate and create budgets. They can identify large expenses which point to areas for improvement. Investors and bankers also use the income statement to assess and evaluate the profitability of a company within a given period. It influences the likelihood of approval on an application for loans or credit and capital investment into the company.

Accuracy is crucial for the income statement to be a useful and give an accurate representation of the financial health of a business. A CPA can assist a business in ensuring and maintaining the correct classifications of accounts in the General Ledger as well as provide guidance and insight into the financial health of a company.

Contributed by Maryney F. Ramirez